If you purchased the money order in-store, you can visit the track-a-transfer page.

#BANK OF AMERICA MONEY ORDER HOW TO#

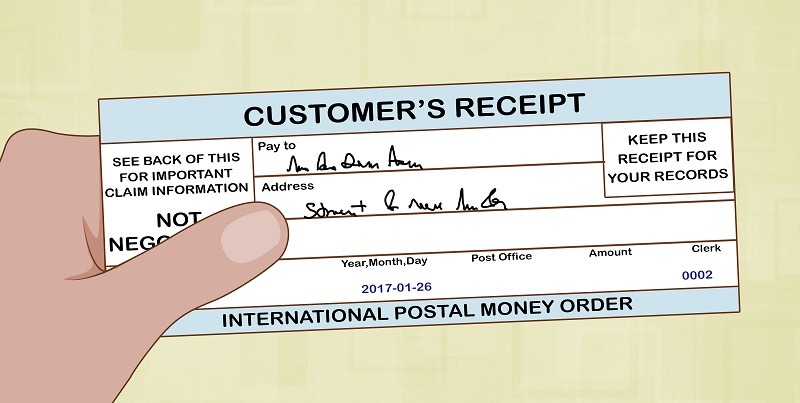

Here’s how to contact three of the most popular money order providers. Remember the issuer is not the reseller or the third party. Contact the issuerĭepending on the issuer, call the customer service number, go online or log into the mobile app. For example, Western Union has a Money Order Custom Request Form, but it’s not guaranteed and requires the original store receipt, up to eight weeks processing time and a $30 fee. You’ll need information about exactly when and where you made the purchase and how much it was for. Yet, if you lost the receipt, you may be able to file paperwork instead. If you have your money order receipt, you’re good to go. Most mail services offer tracking numbers as an option when you mail a package. The provider isn’t a reseller or a third party, like a supermarket or convenience store.Īll issuers have a customer service available and some offer online tracking through their websites or mobile apps.Ī second way to track a money order is by tracking the physical package that contains it, such as the envelope or box in which you sent it. The company’s name will be on your receipt as the “issuer” and is typically your bank, USPS or a money-sending business. The main way to track your money order is through the provider. It also serves as proof of value in case the money order is lost, stolen or damaged. “Always copy or capture the image of your money order, and put a memo or reference line on them for your records and future references.” Said Ohan Kayikchyan, a certified financial planner and founder of Ohan the Money Doctor. How does money order tracking work?Īll vendors provide a receipt that will have the information you need to track a money order. You can send only up to $1,000 per order via USPS. Limits on how much you can send in a money order depends on the vendor. For example, the USPS charges $1.75 for money orders up to $500, $2.40 for orders between $500.01 to $1,000 and only $0.60 for money orders issued by military facilities. The fees themselves are typically nominal. You can pay with cash or debit, but typically you can’t use a credit card to purchase a money order. The vendor will most likely charge a fee, which you pay for on top of whatever amount you’re sending. You’ll need to give their name and address, the payment amount, your name and address and what the payment is for. No matter which outlet you choose, you’ll have to provide details about the recipient to ensure the payment gets to the right person and can be tracked. You can go to several issuers to get a money order, including the United States Postal Service (USPS), most banks and credit unions, large retailers and stores including Western Union and MoneyGram. It’s also typically less expensive than cashier’s checks. It’s safer than cash because only the person to whom you send it is able to use it. “It’s a piece of paper that acts like an exchange instrument for cash.” What is a money order?Ī money order “is another physical monetary instrument much like cash, checks or cashier’s checks,” said Kasey Ring, president of Upward Personal Finance.

Tracking orders, then, can give you peace of mind, or help you figure out what to do if your funds are lost, stolen or damaged. That kind of commitment can cause stress, especially if the money order doesn’t ultimately end up where it’s supposed to go. A money order works just like cash-you pay for it ahead of time and send it to whomever you need to pay.

0 kommentar(er)

0 kommentar(er)